Smile ID, Africa's leading provider of digital identity verification, fraud detection, and AML compliance solutions, announces a strategic collaboration with Skaleet, a banking automation platform that empowers financial institutions to adapt to change. This collaboration provides African banks and Financial Institutions (FIs) with an all-in-one solution that combines Smile ID's identity verification capabilities with Skaleet's core banking platform.

Africa's rapidly growing digital banking sector has created a pressing need for secure and reliable identity verification solutions to combat fraud and ensure compliance with regulatory requirements. By joining forces, Skaleet and Smile ID are poised to address this challenge head-on, empowering financial institutions to deliver secure, inclusive, and user-friendly digital banking experiences to their customers.

Key benefits of the Skaleet-Smile Identity partnership include

- Streamlined Onboarding: Frictionless customer onboarding with swift and secure identity verification.

- Enhanced Fraud Prevention: Robust defense against fraud attempts, ensuring a secure banking environment.

- Operational Efficiency: Seamless workflows and reduced operational costs through automation and efficient verification processes.

- Scalability: The partnership will enable financial institutions to rapidly scale their digital banking operations while maintaining high security and user experience.

Mark Straub, CEO of Smile ID, said, “Our partnership with Skaleet represents a significant milestone in our mission to promote financial inclusion and combat identity fraud in Africa. This collaboration brings together two industry leaders with a proven track record of excellence and innovation. Together, we are committed to delivering solutions that combine the high-security standards with enterprise-level customisation and robust capabilities.”

A Trusted Partnership for Digital Banking Success

Smile ID and Skaleet bring together a wealth of expertise and a proven track record in their respective fields. Smile ID has successfully verified over 100 million identities across Africa, while Skaleet has empowered over 40+ regulated financial institutions and manages 10+ million accounts worldwide.

Brice Groche, Partnerships Director at Skaleet, added: “Skaleet relies on a "Best-of-Breed" approach, selecting the best products and services of the industry that can be integrated into our Core Banking Platform to enable the construction of a whole ecosystem in a seamless way and with the best time to market. Collaborating with Smile ID in Africa allows financial institutions to revolutionise their customer onboarding processes, enhance security measures, and ensure compliance with regulatory requirements. This collaboration opens up a world of possibilities for our clients, enabling them to build trust with their customers, expand their reach, and drive financial inclusion across the continent”.

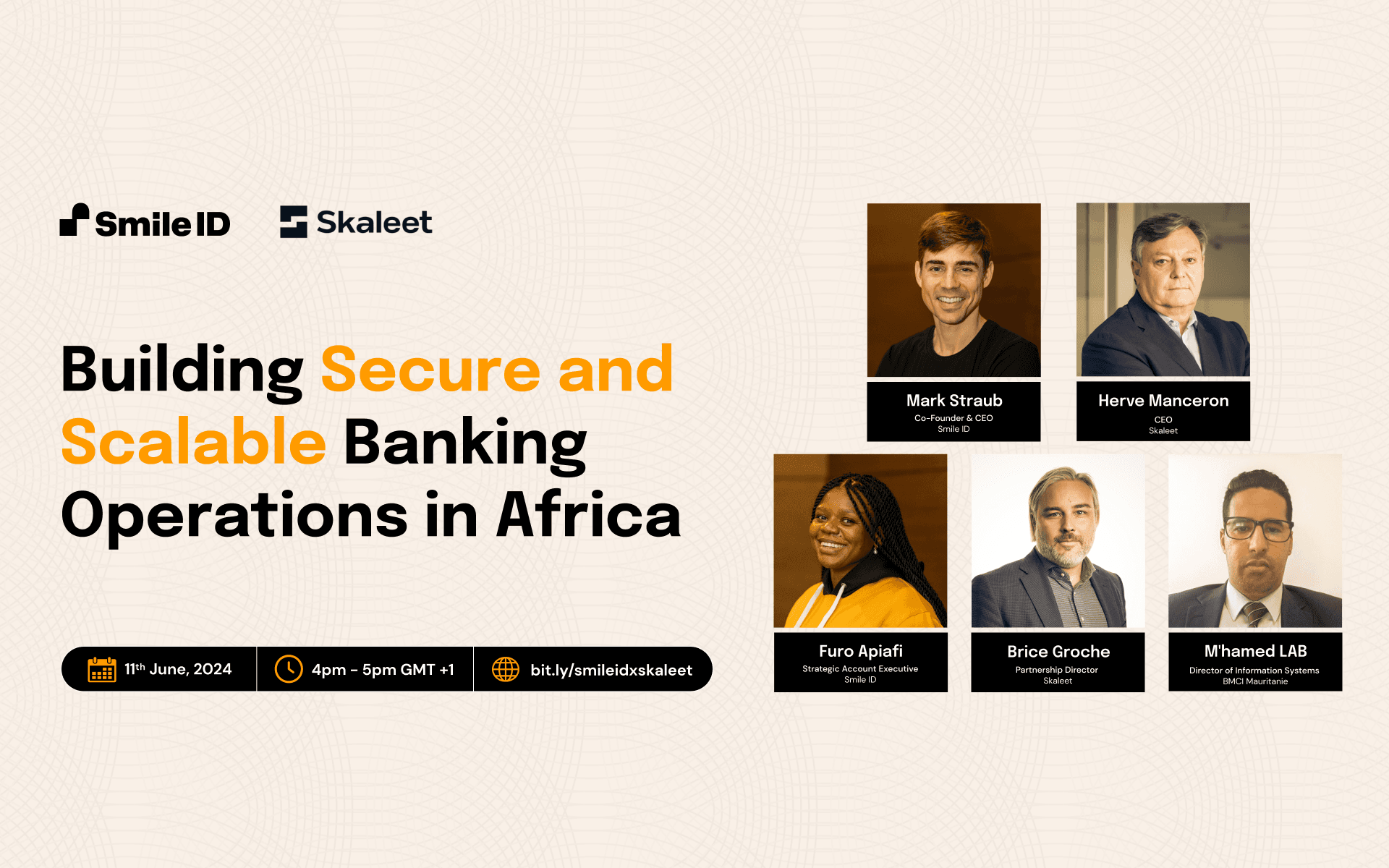

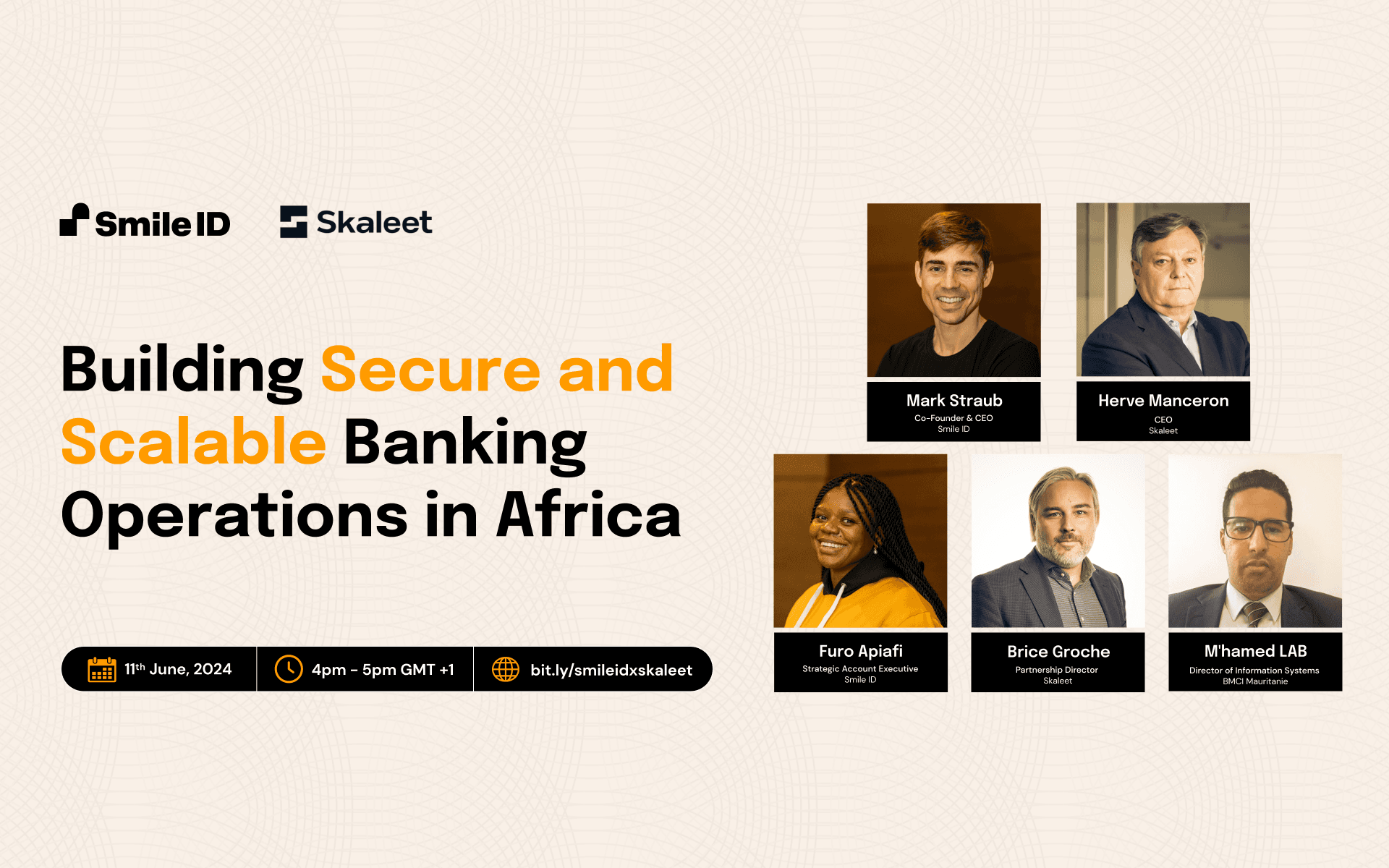

Join Webinar: Building Secure and Scalable Banking Operations in Africa

To learn more about how the Smile ID and Skaleet partnership can benefit your financial institution, register for our upcoming webinar, “Building Secure and Scalable Banking Operations in Africa (product demo)," on June 11th at 4 pm (GMT+1). RSVP here

In the webinar, you will discover practical solutions that African banks and FinTechs can use to streamline onboarding, automate operations, and achieve rapid customer acquisition. Register for the webinar here.

Hervé Manceron, Co-founder, Chairman, and CEO, added, “I am very pleased with this collaboration with Smile ID because it allows us to offer a comprehensive and robust solution that meets their needs more effectively and will help them accelerate the development of new high-value-added services for their end-users."

The Smile ID and Skaleet partnership represents a significant step forward in driving financial inclusion and security in Africa's digital banking sector. With our combined expertise and commitment to innovation, this collaboration is poised to empower African banks and FIs to serve their customers better and contribute to the continent's economic growth.